Turbotax has chosen to go with a rather unusual way of announcing the launching of their new business: a raft of news articles on their website, all done in PDF format. This is strange because faxes used to be a reliable method for media releases back in the days before the Internet. Perhaps it’s a reflection of how things have changed in that era. In any case, it’s a rather unusual tactic for a business that has long made its bones working with newspapers as a marketing and PR agency.

- The articles themselves offer very little in the way of information, other than the company’s name and what it’s doing. And while the company has signed up to the file tax filing process by the state, that’s really all the information that we’ve got to go on. There is no indication, for example, as to whether the company will be able to help those filing electronically, or whether they’ll be able to help anyone else who might need to file electronically. As far as we can tell from reading the article, no one from the company has answered the question “what will Turbotax home and business 2015 federal tax filings involve?”

- While some may view this as a cynical move on the part of the company, it could also represent an attempt to make some face cash in the wake of the uncertainty of the recent economic changes. After all, even filing electronically may not necessarily have any impact on state taxes, since the IRS only requires proof of identification and an address. That said, it’s still better to play it safe than sorry when it comes to business and personal finances, and filing federal and state taxes on your own can be a daunting task.

- You may also think about contacting your local state tax commission or IRS. Unfortunately, we don’t know what the IRS will do next, even after the election. Will they pass on some sort of stimulus package? Will they offer some sort of debt relief package to help businesses cope with the fallout of the economic slowdown? We don’t know, and we aren’t sure anyone does, so it makes sense to start shopping around for a TurboTax home and business preparation program now before anyone takes advantage of the available federal and state tax opportunities during the filing season.

- Some may argue that the application process for filing federal and state taxes has been more difficult over the past few years. That may be true, but Turbo Tax itself seems to have made things easier for millions of taxpayers in the wake of the IRS controversy. The program is still undergoing changes and improvements, but it’s already making a positive impact on the thousands of individuals who use it every year. The time may be ripe for another round of congressional debates over the regs, but until that time, Turbo Tax is the only legal way for most people to take full advantage of their income taxes.

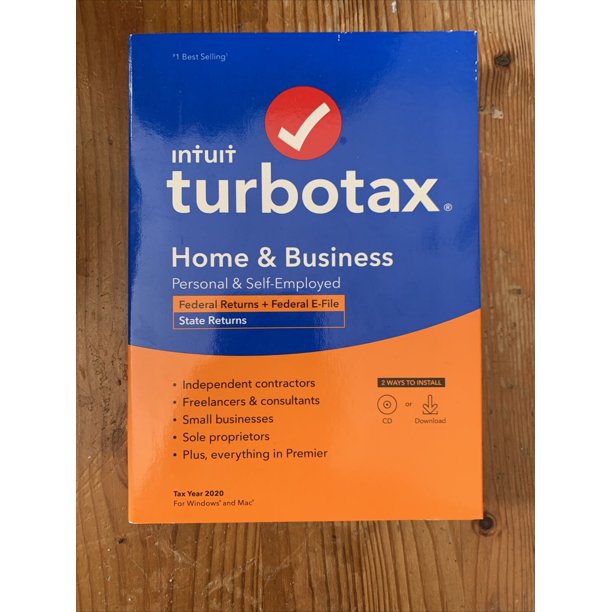

While the Turbo Tax Home and Business Selections torrent may still be available through some sources online, the Intuit TurboTax software program is typically considered a better value for both taxpayers and businesses. It’s also the most popular option among those who are serious about filing their federal and state taxes this year. If you’re interested in getting your taxes ready for filing, you should definitely visit the official site today. It’s an easy process filled with helpful tips that will help you make smart choices and avoid the common mistakes that can turn your income into a big financial loss. And it’s free!